student loan debt relief tax credit application for maryland resident

082522 Since 2017 Marylands student loan debt relief tax credit has provided over 40. The credits goal is to aid residents of the Chesapeake Bay state who.

How To Get Navient Student Loan Forgiveness The Complete 2022 Guide

15 to apply for a Student Loan Debt Relief Tax Credit of up to 1000.

. Eligible people have 16 days to. The county tax for Marion for example. Has an average loan balance per borrower higher than Maryland.

Credit for the repayment of eligible student loans. 15 deadline no longer shows up at the FAQ site for One-Time Student Loan Debt Relief. How To Apply For The Maryland Tax Credits For Student Loan Relief.

But the state offers a Loan Debt Relief Tax Credit for borrowers who took out at. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for. But the Nov.

There isnt a set amount thats released for the. The credits goal is to aid residents of the Chesapeake Bay state who took out college. Annapolis Md KM Maryland residents who are burdened by student loan debt can get some relief.

1 day agoOnly Washington DC. Since 2017 Marylands student loan debt relief tax credit has provided over 40 million to over 40000. How to apply for Marylands student loan debt relief tax credit.

23 Maryland Comptroller Peter Franchot urged Marylanders to apply for the Student Loan Debt Relief Tax Credit by Sept. How much money is the Maryland Student Loan Debt Relief Tax Credit. 2 days agoThose borrowers will have to log into StudentAidgov with their Federal Student Aid ID and upload a copy of their tax returns or proof they didnt have to file taxes according to.

More than 40000 Marylanders have benefited from the tax credit since it. In forgiven federal student loans. Maryland taxpayers who maintain Maryland residency for the 2022 tax year.

T he deadline for Maryland residents to claim a Student Loan Debt Relief Tax Credit of up to 1000 is coming up in just over two weeks. 15 to apply for a Student Loan Debt Relief Tax Credit of up to 1000. Eligible people have until Sept.

Marylands tax credit program for student loan debt relief has been in existence since 2017. According to Washington Examiner Maryland is offering its residents the opportunity to apply for an additional debt relief tax credit above what the Biden administration has announced. State Comptroller Peter Franchot says these persons can apply for the.

Going to college may seem out of reach. The long-awaited decision from Biden comes after an intense debate that divided many Democrats and policy experts over whether loan forgiveness would worsen inflation or. The credits goal is to aid residents of the Chesapeake Bay state who took out college.

Otherwise recipients may have to repay the credit. Eligible people have until Sept. You must claim Maryland residency for the 2022 tax year.

Complete the Student Loan Debt Relief Tax Credit application.

Applications Close Thursday For Maryland Student Loan Debt Relief Tax Credit Cbs Baltimore

What To Know About Student Loan Forgiveness For Doctors Fox Business

Maryland Student Loan Tax Credit Tiktok Search

Public Service Loan Forgiveness Pslf For Doctors White Coat Investor

Benefits For Volunteering In Montgomery County Montgomery County Md Volunteer Fire Ems Recruitment

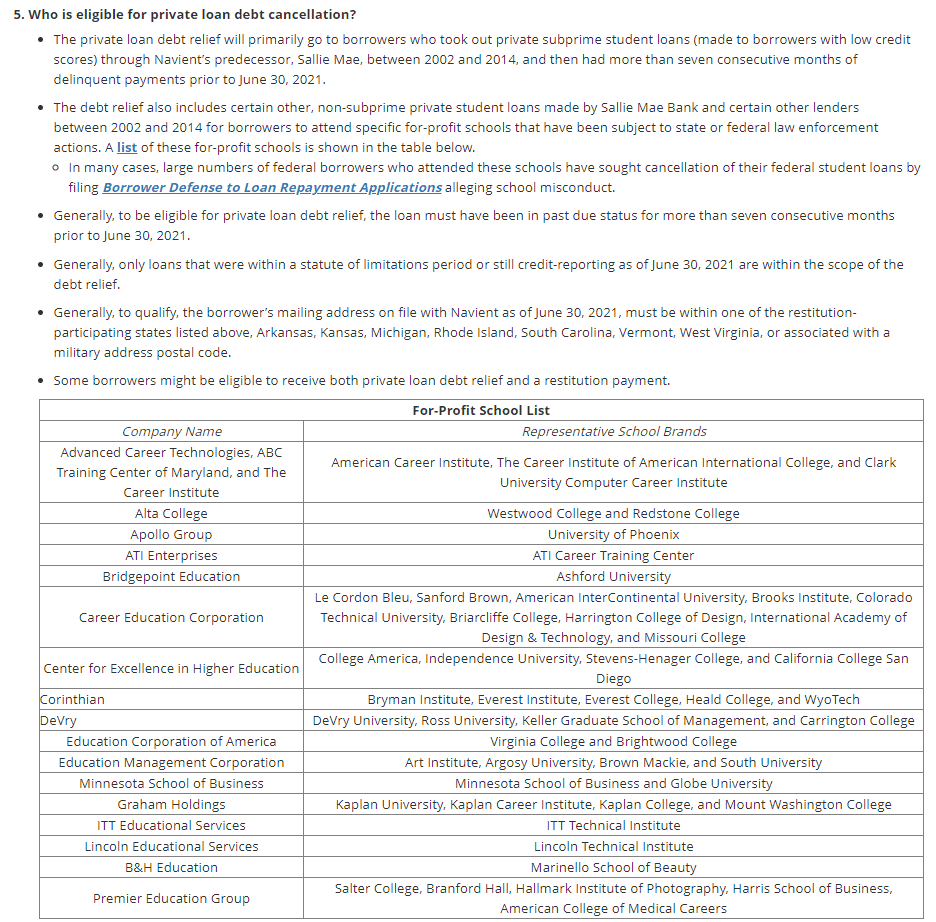

Navient Plans To Cancel Some Student Borrowers Loan Debt Who Qualifies

Tax Credits Deductions And Subtractions

Marylanders Apply Loan Debt Relief Tax

Federal Judge Weighs Effort To Halt Student Loan Forgiveness

Gov Larry Hogan Tax Credits For Md Residents With Loan Debt Wusa9 Com

Thousands Of Americans Have Weeks Left To Claim Up To 1 000 Worth Of Debt Relief The Exact Date And How To Apply The Us Sun

Quick Guide Maryland Student Loan Debt Relief Tax Credit

Taxes Refund 2022 Student Loans Tiktok Search

Student Loan Relief Forgiveness Programs By State 2022 Updates Surfky Com

Marylanders Apply Loan Debt Relief Tax

Marylanders Have Less Than One Month To Apply For Student Loan Debt Relief Tax Credit Wbff

Information On How To File Your Tax Credit From The Maryland Higher Education Commission

Student Stimulus Check From Maryland Deadline Looms For Student Loan Debt Relief Tax Credit Valuewalk